Operational Due Diligence

The Capital Allocation Compass.

Verify real potential before capital is committed.

Financial audits are not enough

The Valuation Gap

Traditional ODD validates past EBITDA. It assumes the operating engine behind it is sound.

In industrial assets, value erosion happens upstream:

Deferred maintenance

“Heroic” operations

Hidden capacity constraints

This is where Operational Due Diligence begins.

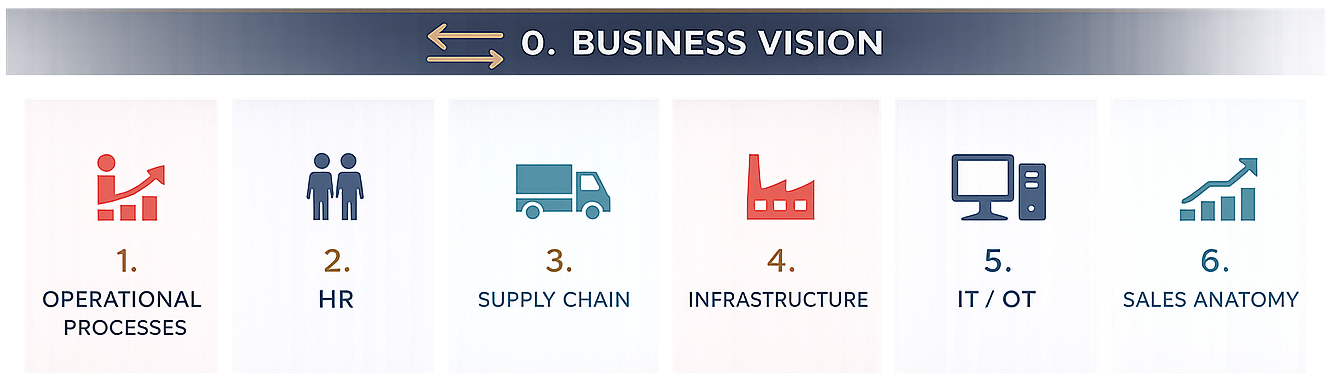

What Operational Due Diligence really evaluates

Truth. Upside. Capital.

We answer three critical questions to support your capital allocation decisions.

Are reported KPIs reflecting real operational performance today?

Can identified gaps be converted into economic results?

Is/Will invested CAPEX deliver value?

How we execute it

A disciplined operational analysis of the asset.

COGS — The Production Engine

Operational yield & throughput

Direct labor productivity

•Asset health & maintenance exposure

Inbound cost structure

SG&A — Structural Support

Span of control, overhead efficiency

Logistics cost structure

Customer risk & margin quality

ERP reliability, data availability, digital maturity

Executive Summary

Investment Verdict

Based on operational capacity and financial baseline assessment.

Valuation Impact

Current vs. Potential (Upside from OPEX improvements)

Risk Assessment

Stop-Loss factors identified during the audit.

Why Saikaris

Our guarantee

Lean Six Sigma Black Belt discipline

10+ countries frontline delivery

Training systems & standardization

AI validation & deployment experience

"We align our incentives with yours. If we don't find significant value for you, our fees are capped at expenses."